The Q2 2025 GDP growth rate of 3.8% is a solid print, well above expectations.

1️⃣ Fed Policy Implications

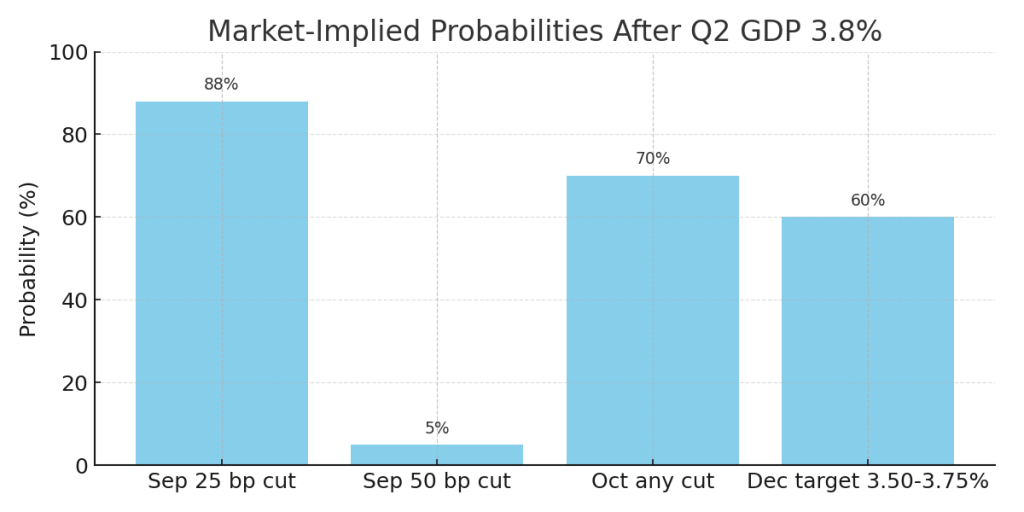

- Stronger-than-expected growth reduces the likelihood of immediate rate cuts.

- If inflation remains above target, the Fed could pause easing or even signal caution for future cuts.

- Markets may now price fewer total rate cuts in 2025, especially in October and December.

2️⃣ Stock Market Implications

- Cyclicals benefit: Industrials, materials, consumer discretionary, tech hardware/semiconductors may rally.

- Defensives lag: Utilities, REITs, consumer staples underperform in a strong-growth environment.

- Rate-sensitive tech: High-multiple growth stocks may face short-term pressure if the market thinks Fed cuts will be smaller or slower.

3️⃣ Bond Market Implications

- Treasury yields rise, particularly in the short- and intermediate-term, as expectations for Fed cuts decline.

- Bond prices fall as yields climb.

4️⃣ Currency & Commodities

- USD strengthens: Strong growth attracts global investment flows.

- Gold declines: Higher yields reduce safe-haven appeal.

- Commodities/oil rise: Stronger growth signals higher demand.

5️⃣ Market Summary Table

| Asset | Likely Reaction |

|---|---|

| Stocks (cyclical) | ↑ |

| Stocks (defensive) | ↓ |

| Bonds | ↓ (yields ↑) |

| USD | ↑ |

| Gold | ↓ |

| Commodities | ↑ |

Key takeaway: Q2’s 3.8% GDP signals the U.S. economy is resilient, lowering the probability of aggressive Fed rate cuts. Cyclical sectors and commodities are poised to benefit, while bonds, gold, and defensive equities may see headwinds.

Discover more from Evergreen Financial News

Subscribe to get the latest posts sent to your email.