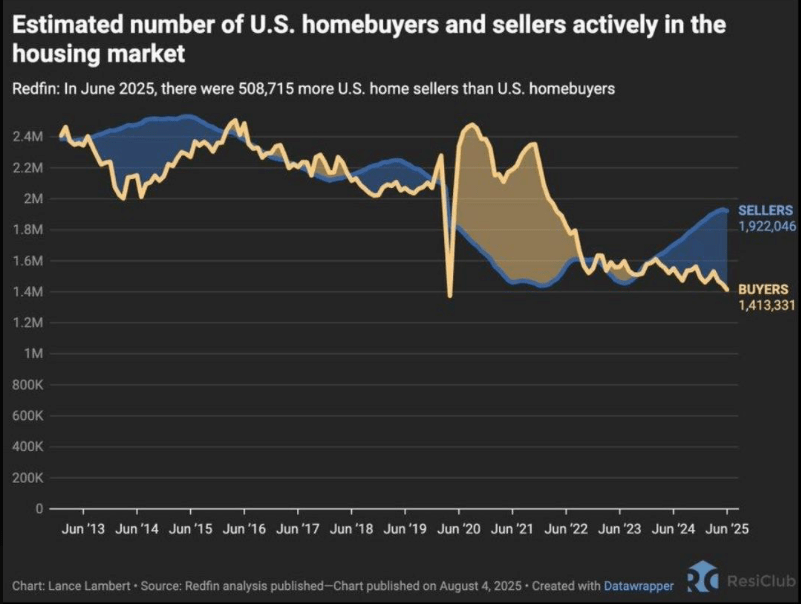

Latest housing data shows more sellers than buyers.

This signals an imbalance in the real estate market that can ripple out into the broader economy and financial markets. Here’s how it can play out:

🏠 Housing Market Dynamics

- Excess supply vs. demand → home prices fall or stagnate.

- Buyers hold back, anticipating lower prices later.

- Sellers may be forced to cut prices, accept longer time-to-sell, or pull listings.

📊 Broader Market Impacts

1. Consumer Wealth & Spending

- Housing is the largest asset for most households.

- Falling home prices = negative wealth effect → consumers feel poorer, spend less on retail, travel, durable goods.

- This can slow GDP growth.

2. Construction & Jobs

- If homes sit unsold, builders slow new projects.

- That hits construction jobs, suppliers (lumber, steel, appliances), and related industries.

- Weaker housing demand can worsen an already slowing labor market.

3. Banking & Credit

- Mortgage activity slows → banks earn less from originations/refinancing.

- Falling home values raise credit risks (especially for regional banks exposed to real estate lending).

- May tighten credit conditions across the economy.

4. Inflation & Fed Policy

- Housing (shelter) makes up a big chunk of CPI.

- More sellers than buyers = downward pressure on rents and home prices → eases inflation.

- Could give the Fed more room to cut rates.

5. Stock Market Sectors

- Bearish impact: Homebuilders, REITs, building materials, mortgage lenders.

- Potentially bullish: Rate-sensitive sectors (tech, utilities) if Fed cuts sooner in response.

⚖️ Bottom Line

- Short-term: Rising supply vs. weak demand in housing pressures home prices, dampens consumer confidence, and weighs on housing-related stocks.

- Medium-term: If it eases inflation, it could accelerate Fed rate cuts, which may help broader equities and bonds.

- Risk: If housing weakness deepens, it can spill into banking and consumption, raising recession risks.